Introduction:

YavaBook is designed with small businesses in mind. Offering essential features like invoicing, expense tracking, and financial reporting for free, it eliminates the need for costly alternatives. Its user-friendly interface ensures anyone can start managing their books quickly. YavaBook is more than software—it’s a financial partner for small businesses.

The Unique Challenges of Small Business Accounting

Small businesses often face these financial management hurdles:

Limited Budgets: Many small businesses cannot afford expensive accounting tools or dedicated staff.

Time Constraints: Business owners frequently lack the time to manually track finances.

Compliance Requirements: Ensuring tax and regulatory compliance can be complex.

Growth Needs: Scaling operations requires flexible tools that grow with the business.

To overcome these challenges, small businesses need accounting software that’s affordable, intuitive, and scalable. Explore Top Features to Look for in Small Business Accounting Software for more insights.

Why Choose YavaBook for Your Small Business?

Unlike many paid and free alternatives, YavaBook offers a comprehensive, user-friendly solution tailored to the needs of small businesses. Here’s what makes it stand out:

1. Free Forever

YavaBook provides all essential accounting features at no cost, eliminating the need for a costly subscription. This makes it ideal for startups and small businesses working with limited budgets.

2. Intuitive Design

You don’t need to be an accountant to use YavaBook. Its interface is designed to be simple and intuitive, enabling anyone to manage finances effectively.

3. Comprehensive Features

YavaBook combines all the must-have features for small businesses in one platform:

Invoicing: Create and send professional invoices with ease.

Expense Tracking: Automatically categorize and monitor expenses.

Real-Time Reporting: Gain valuable insights into cash flow and profitability.

4. Cloud-Based Accessibility

Manage your finances anytime, anywhere. Whether you’re at the office or on the go, YavaBook’s cloud-based system ensures you’re always in control.

5. Tax Compliance Tools

In regions like Singapore, tax compliance is critical. YavaBook simplifies GST reporting, ensuring businesses stay compliant without extra effort. Learn more in Free Accounting Software in Singapore: A Guide to Making the Right Choice.

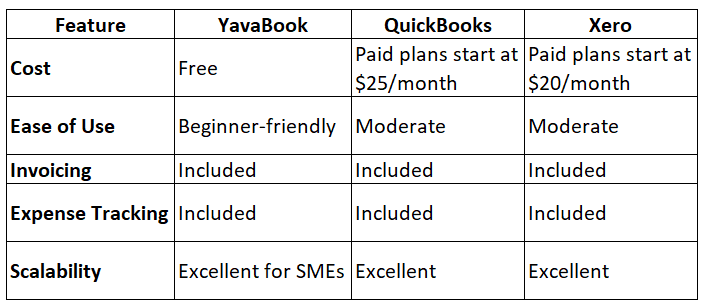

Comparing YavaBook with Paid Tools

Many small businesses consider paid tools like QuickBooks or Xero but often find them overcomplicated or expensive. Here’s how YavaBook compares:

For detailed comparisons, read QuickBooks vs YavaBook: Which Accounting Software Should You Choose?.

How Small Businesses Are Benefiting from YavaBook

Many small businesses have already adopted YavaBook to streamline their accounting processes. Here’s an example:

Case Study: A Retail Store’s Success

A small retail store was struggling with manual expense tracking and delayed invoicing. After switching to YavaBook, they:

Automated invoice generation, reducing late payments by 50%.

Categorized expenses for better budgeting and forecasting.

Gained real-time insights into cash flow, enabling better financial decisions.

This transformation helped the business save hours each month and focus more on growth.

Tips for Getting Started with YavaBook

Set Up Your Account: Sign up for free and customize your dashboard.

Sync Your Data: Connect bank accounts for seamless expense tracking.

Utilize Reports: Use real-time insights to guide your financial planning.

For detailed guidance, read How to Download and Set Up Free Accounting Software in 5 Easy Steps.

Frequently Asked Questions

Is YavaBook really free?

Yes, YavaBook is free forever, with no hidden charges or subscription fees.Can YavaBook handle tax compliance?

Absolutely! YavaBook supports GST reporting and other compliance features, making it suitable for businesses in regulated markets.Is it secure?

YavaBook employs robust encryption protocols to ensure your financial data is safe.

Conclusion

YavaBook stands out as the go-to accounting software for small businesses, offering an unbeatable combination of cost, usability, and features. Whether you’re a startup, freelancer, or growing enterprise, YavaBook provides the tools you need to simplify financial management and focus on growing your business.

Ready to experience the difference? Sign up for YavaBook today and take control of your finances with ease.

Article by

Webb Poh

CEO and Founder

Published on

Jul 1, 2024