Introduction:

Free accounting software has revolutionized bookkeeping for small businesses. YavaBook, for instance, provides tools to automate expense tracking, generate invoices, and prepare reports—all at no cost. Learn how to use free software to simplify your bookkeeping tasks in 2025.

Why Use Free Accounting Software for Bookkeeping?

Cost-Effective

Free accounting software eliminates subscription fees, allowing businesses to allocate resources to other critical areas.Time-Saving

Automation features like recurring invoices and categorized expense tracking reduce manual work.Error Reduction

Automated calculations minimize human errors in financial records.Real-Time Insights

Gain instant access to financial data, enabling better decision-making.

For more benefits of free tools, read How Free Accounting Software Can Save Your Small Business Time and Money.

Key Bookkeeping Tasks Simplified by Free Software

Expense Tracking

Automatically categorize and monitor expenses to understand where your money is going. Tools like YavaBook streamline this process with real-time dashboards.Invoicing

Create professional invoices with ease. Automate reminders for overdue payments to improve cash flow.Financial Reporting

Generate essential reports, such as profit and loss statements and balance sheets, to assess your financial health.Tax Compliance

For Singaporean businesses, GST-ready invoicing and reporting features in YavaBook simplify tax preparation. Learn more in Free Accounting Software in Singapore: A Guide to Making the Right Choice.

Step-by-Step Guide to Using Free Accounting Software

Choose the Right Software

Evaluate options based on your business needs. YavaBook is ideal for startups and small businesses seeking simplicity and affordability.Set Up Your Account

Create an account on the platform.

Add your business details, including GST information if applicable.

Customize Categories

Organize income and expenses into categories such as utilities, salaries, and marketing.

Set up tax codes for compliance purposes.

Automate Key Tasks

Schedule recurring invoices.

Sync your bank account for automatic expense tracking.

Generate Reports

Use built-in reporting tools to create profit and loss statements, cash flow summaries, and tax-ready reports.

For step-by-step instructions, check out How to Download and Set Up Free Accounting Software in 5 Easy Steps.

Why YavaBook Is the Perfect Choice for 2025

YavaBook is a free, user-friendly accounting platform designed for small businesses. Here’s why it’s an excellent choice for bookkeeping in 2025:

Expense Management: Automatically track and categorize expenses.

GST Compliance: Generate GST-ready invoices and reports.

Real-Time Insights: Monitor your financial performance at a glance.

No Hidden Costs: Access all features without any subscription fees.

For more details, explore Why YavaBook Is the Best Free Accounting Software for Singaporean SMEs.

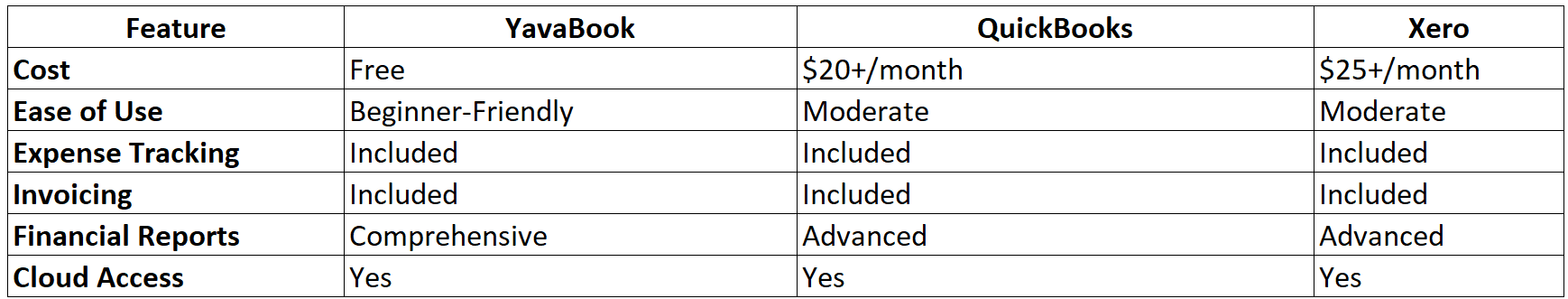

Free vs Paid Accounting Software for Bookkeeping

For a detailed comparison, see Xero Accounting vs Free Alternatives: Are Paid Tools Worth It?.

Real-Life Use Case: A Small Business Success Story

A boutique photography business in Singapore relied on manual bookkeeping, which led to missed invoices and tax compliance challenges. Here’s how switching to YavaBook transformed their operations:

Automated Bookkeeping: Reduced time spent on expense tracking by 50%.

Improved Cash Flow: Automated invoicing minimized delays in payments.

GST Compliance: Simplified tax reporting saved hours during tax season.

For more success stories, check out Small Business Accounting Software: A Game-Changer for Entrepreneurs.

Tips for Effective Bookkeeping in 2025

Update Data Regularly

Keep your software up-to-date with daily expense and income entries.Leverage Automation

Use automation features like recurring invoices and bank reconciliation to save time.Review Reports Monthly

Analyze your profit and loss statements to identify growth opportunities and potential risks.Ensure Tax Compliance

Use built-in compliance tools to prepare accurate tax filings.

For more guidance, see How to Choose the Best Accounting Software for Your Business Needs.

Conclusion

Free accounting software like YavaBook empowers businesses to handle bookkeeping tasks efficiently and affordably. With features such as expense tracking, invoicing, and GST compliance, YavaBook makes financial management simple for startups and small businesses.

Ready to simplify your bookkeeping? Sign up for YavaBook today and take control of your finances in 2025.

Article by

Webb Poh

CEO and Founder

Published on

Jul 29, 2024