Introduction:

Entrepreneurs often juggle multiple roles, making accounting software essential. YavaBook provides tools to manage invoices, track expenses, and generate reports—all for free. Empower your business with software that simplifies your financial tasks.

Why Small Business Accounting Software Matters

Time Savings

Automation features like recurring invoices and expense tracking reduce manual work, allowing entrepreneurs to focus on growing their businesses.Improved Accuracy

Automated calculations minimize human errors, ensuring accurate financial records.Cost-Effective Solutions

Free tools like YavaBook provide robust features without subscription fees, making them ideal for startups and small businesses.Compliance Made Easy

Built-in compliance tools simplify tax preparation, ensuring businesses meet local regulations.

For more on the advantages of automation, check out Simple Accounting Software to Simplify Your Bookkeeping Tasks.

Key Features of Small Business Accounting Software

Expense Management

Track and categorize expenses automatically to maintain a clear view of your financial health.Professional Invoicing

Generate and send professional invoices with ease. Automate reminders for overdue payments to improve cash flow.Real-Time Financial Reporting

Access instant insights into your business’s performance with tools like profit and loss statements, cash flow summaries, and balance sheets.Tax Compliance Tools

Platforms like YavaBook provide GST-ready invoicing and reporting features, ensuring compliance with local tax laws. Learn more in Affordable Accounting Solutions for Singaporean Businesses.Scalability

As your business grows, accounting software should adapt to your changing needs, offering additional features like multi-user access and inventory management.

Why YavaBook Is a Game-Changer for Entrepreneurs

YavaBook is specifically designed for small businesses and startups, providing essential features in a user-friendly, cost-free package. Here’s why it’s a top choice for entrepreneurs:

Expense Tracking: Automatically categorize expenses for better financial oversight.

GST Compliance: Perfect for businesses in Singapore, with built-in GST features.

Real-Time Reporting: Gain instant access to key financial metrics.

No Costs: Completely free, making it accessible for budget-conscious entrepreneurs.

Discover more in Accounting Software for Small Businesses: What Makes YavaBook Stand Out?.

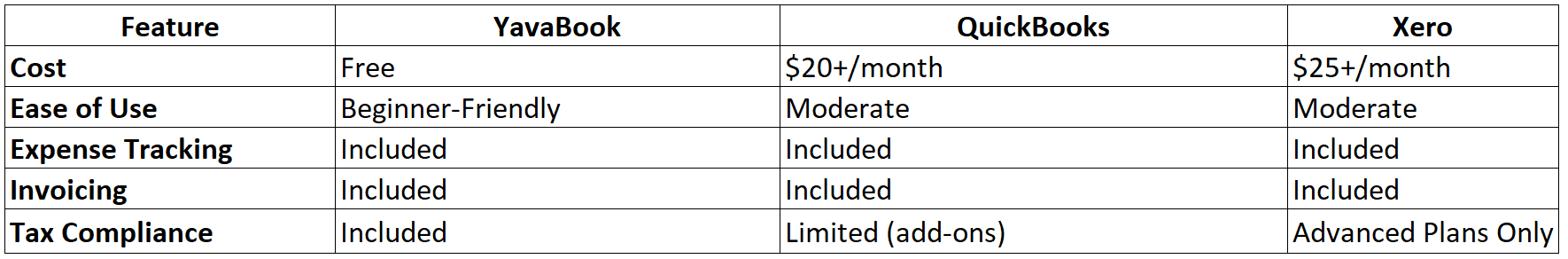

Comparison: YavaBook vs Paid Accounting Software

For more on the benefits of free tools, read Xero Accounting vs Free Alternatives: Are Paid Tools Worth It?.

Real-Life Success Story: A Small Business Transformation

A local bakery in Singapore was overwhelmed by manual bookkeeping, which led to missed invoices and inaccurate tax filings. Here’s how YavaBook transformed their operations:

Automated Bookkeeping: Saved hours weekly with automated expense tracking.

Improved Cash Flow: Faster invoicing reduced overdue payments by 40%.

GST Compliance: Simplified tax reporting, avoiding penalties and delays.

Explore more success stories in Streamline Church Finances with Free Church Accounting Software.

How to Choose the Right Accounting Software

Define Your Needs

Determine whether you need basic tools (e.g., invoicing and expense tracking) or advanced features (e.g., multi-currency support).Set a Budget

Free platforms like YavaBook are ideal for businesses looking to save costs.Test Features

Many platforms offer free trials or demo versions. Start with a free tool like YavaBook to see if it meets your requirements.

For more tips, see How to Choose the Best Accounting Software for Your Business Needs.

Tips for Using Accounting Software Effectively

Leverage Automation

Use features like recurring invoices and automatic expense categorization to save time.Generate Reports Regularly

Analyze financial reports monthly to track progress and identify areas for improvement.Ensure Compliance

Use built-in tax tools to prepare accurate filings and avoid penalties.Involve Your Team

Train staff on how to use the software effectively to streamline collaboration.

For setup guidance, read How to Download and Set Up Free Accounting Software in 5 Easy Steps.

Conclusion

Small business accounting software is transforming the way entrepreneurs manage their finances. With tools like YavaBook, you can automate tasks, reduce errors, and gain real-time insights—all without the financial burden of paid subscriptions. For startups and small businesses, YavaBook is a cost-effective, user-friendly solution that empowers growth.

Ready to simplify your financial management? Sign up for YavaBook today and take control of your business finances with ease.

Article by

Webb Poh

CEO and Founder

Published on

Aug 8, 2024